one reason why Alberta crude doesn't sell on the world market

Tanker Aqualeader

_thumb.jpg)

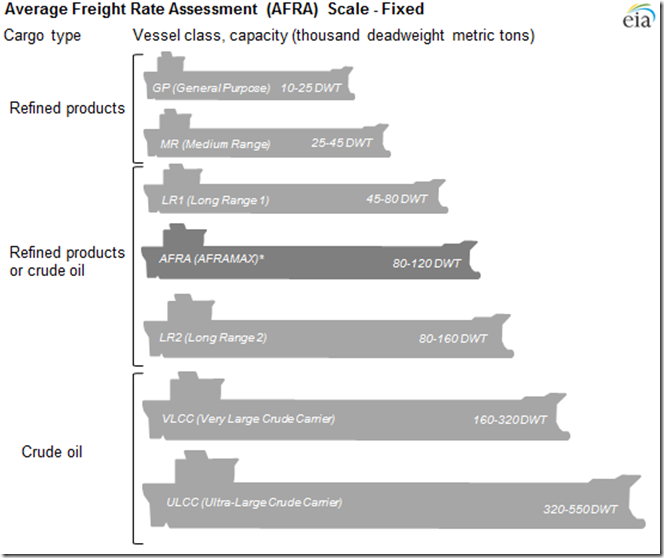

On October 15th the tanker Aqualeader left the Port of Vancouver loaded with Alberta crude heading for Ningbo China. The Aqualeader is classed as a large Aframax tanker which is a medium-sized crude tanker with a dead weight tonnage (DWT) ranging between 80,000 and 120,000 (Aquadleader tips in at 115,669 t).

This is as big a tanker as can enter the port of Vancouver due to low height restrictions on the Ironworkers Memorial Bridge at the second narrows that the tanker must pass to get to the Westridge Marine Terminal to load crude. The Aqualeader can carry roughly 750,000 barrels of crude however due to shallows at the seconds narrows its capacity is restricted to about 80% (with favorable tides) and on this day the Aqualeader left Vancouver with about a 60% load or about 450,000 barrels of crude which gave it a draught (depth in water) of 11.9m

Tanker New Odyssey

A little further to the south in Long Beach California the tanker New Odyssey was loaded and left for Qingdao China on August 12th. The New Odyssey (DWT 318445 t) is a VLCC (Very Large Crude Carrier) and carries about 2,000,000 barrels of crude and it left fully loaded with a draught of 20.4m

So why does this matter?

The buyer of the crude pays shipping so for example when the Chinese bought the Alberta crude, it purchased it at Hardisty Alberta and the buyer is responsible to pay pipeline charges to get it to Vancouver which depends on the grade of the oil but we’ll say about $4.00 per barrel, then they would have to pay for the tanker to get it to China and sending 4 partial loaded Aframaxs to equal the amount of crude the New Odyssey carries is substantially more expensive. So it should be obvious that buying American crude shipped from Long Beach California is far cheaper for the buyer then buying Alberta crude from Vancouver, toss in the pipeline charges and buyers really aren’t big fans of Alberta crude. This is only one of the problems with selling Alberta crude on the world market that no one wants to talk about. Expanding the capacity of the TransMountain pipeline does not fix this problem and as such we will see very little of increased sales of Alberta crude to world markets (but we will see an increase in discounted crude sales to the Washington state refineries, especially now that Alaskan crude is being exported directly to China from Valdez, so who exactly does this expanded pipeline benefit?).